Whenever people invest in a certain market, they are betting on the strength of that country or economy. It’s a bet on whether development and progress will sustain growth in the long run. They may also be betting on the political system—whether it’s stable, whether property rights are respected, and whether there is economic freedom. In this assessment, democracy and human rights have generally not been the decisive factors for investors. What has mattered more is that the political system is stable. Because of this, China has managed to attract vast amounts of foreign investment over recent decades, even though its citizens live under a dictatorship and enjoy minimal civil rights. Some even argue that democracy could be a disadvantage, as populists or extremists could gain power and radically change everything. Here, Mussolini’s famous words come to mind: “Democracy is a kingless regime infested by many kings who are sometimes more exclusive, tyrannical and destructive than one, even if he be a tyrant.”

We often hear discussions about elections in Europe as if everything is at stake, with warnings that radicals might come to power, potentially leading to unspecified disasters. For example, the victory of the Brothers of Italy party in October 2022 made Giorgia Meloni the first woman to become Prime Minister of Italy. The dire predictions made when she took office have largely come to nothing, and she seems to have performed well in economic matters.

Similarly, discussions around the upcoming U.S. elections on November 5 have taken on a similar tone. It’s as if everything depends on whether or not Donald Trump returns to the presidency. Without taking a stance on whether a Trump or Kamala Harris victory would be more beneficial for the economy, there’s reason to urge investors to trust in democracy. Economic growth and productivity in the U.S. seem relatively unaffected by the particular individuals in office at any given time, with these factors instead shaped by institutional frameworks and the strength of the economy. The American economy is extremely strong and has, in fact, outpaced Europe and Asia. There is little to suggest that the election of either Trump or Harris would change this.

Nevertheless, it is interesting to consider the significance and outcomes of the U.S. presidential elections.

At Spakur Invest’s most recent briefing on October 8, there was a discussion about the upcoming elections and the potential economic impact these U.S. elections might have. We were joined by one of Iceland’s most experienced figures in these matters, both with respect to politics and economics, Geir H. Haarde, former Prime Minister of Iceland.

At the event, guests were treated to a chocolate cake divided into two halves—blue and red. Here it’s worth noting that red represents Republicans and blue represents Democrats. This informal “poll” on the outcome of the upcoming November 5 election mirrored Geir’s belief that the election would be a close one, as equal portions of the red and blue cake were cut.

It’s worth adding that in recent years, there has been a significant reassessment of how to properly gauge political risk, with democracy now viewed as a far more important positive factor than previously believed. For instance, foreign investment in China has decreased significantly as investors lose confidence in the country’s political system for various reasons. Democracy is the only political system that ensures stability and progress in the long run, and it is crucial to trust voters at the ballot box.

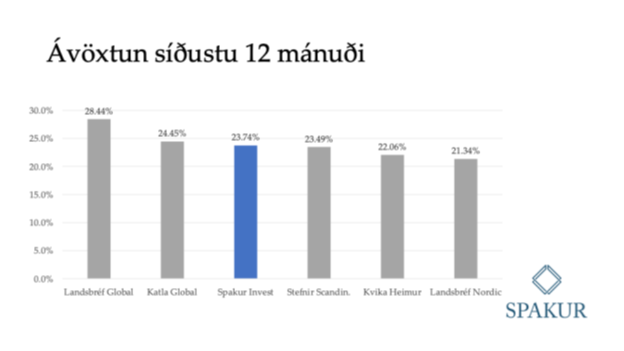

It’s not without reason, therefore, that Spakur Invest has 90% of its portfolio in publicly listed U.S. stocks, with the fund performing very well over the past 12 months. Spakur Invest emphasizes long-term returns by investing in listed companies with solid underlying operations and a clear competitive advantage. The coming years are expected to yield good returns for companies that align with Spakur Invest’s investment strategy.

Below, you can see the fund’s returns over the past 12 months as of October 8, compared to the returns of other funds that invest in foreign equities.